Zemen Bank to raise 100 million Birr in capital after leap in profit

Addis Ababa, Ethiopia - The last fiscal year was challenging for the only one-branch bank, Zemen. It was embroiled in a controversy surrounding a default on the 20-million birr loan it extended to a pioneer car assembler in Ethiopia, Holland Car Plc, after the latter went bankrupt.

Addis Ababa, Ethiopia - The last fiscal year was challenging for the only one-branch bank, Zemen. It was embroiled in a controversy surrounding a default on the 20-million birr loan it extended to a pioneer car assembler in Ethiopia, Holland Car Plc, after the latter went bankrupt.

With the bankruptcy proceeding still unsettled, Zemen faced another hiccup involving its former board chairman, Ermias Amelga, and his company Access Real Estate; the bank had to come out public to refute suspicious claims regarding involvement with the real estate developer.

The other challenge that the bank has to cope with during the same fiscal year was the shortage of foreign currency that reigned over the industry.

According to Ermias Eshetu, vice president for Marketing and Corporate Services, the challenges faced by the bank were not enough to slow down its performance. Against the odds, Zemen’s financial books indicated a gross profit of 123.8 million birr for the year in question, which translated to a 41 percent earning per share for shareholders.

The bank’s mainstay during the last fiscal year and the ones before has been its international banking branch focusing on export oriented businesses. Hence, it has secured 94 million birr net profit from its operations, registering a nine percent leap over its profit for 2011/12 fiscal year. Over the last four years, Zemen has consistently delivered close to 50 percent earnings per share for its shareholders, Ermias said.

Following this year’s achievements, the board of directors has decided to raise 100 million birr additional capital, Ermias told The Reporter. He also mentioned that Zemen was able to transact a bit over a quarter-of-a-billion dollars via its foreign exchange window. Ermias further noted that these days, the shortage of foreign currency has become one of the most critical challenges to many commercial banks in Ethiopia. During the same time, Zemen managed to mobilize USD 265 million in foreign assets.

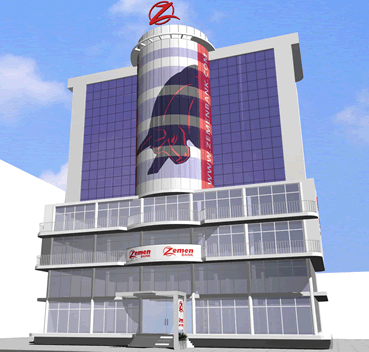

With regard to its headquarters, both preliminary and detail design of the headquarters building has been reviewed, Ermias noted. However. he declined to reveal the total cost of headquarters project.

Zemen’s outstanding loan portfolio reached 1.4 billion birr as of the 2012/13 fiscal year while it managed to mobilize a total of 2.5 billion birr in deposit.

Zemen, which was formed five years ago has some 4,000 account holders whom it serves via its main branch and various bank kiosks around the city. Meanwhile, the Automated Teller Machines (ATMs) of bank also cater for some 30,000 customers who transact at a rate of 31 million birr per month.